US Dollar Index looks cautious around 103.60, Fed gathering starts today

- DXY trades without a clear direction in the mid-103.00s.

- US yields edge higher ahead of the FOMC event on Wednesday.

- Factory Orders, JOLTs next on tap in the US docket.

The greenback, in terms of the US Dollar Index (DXY), lacks a clear direction although it manages well to navigate in the upper end of the recent range north of the 103.00 hurdle.

US Dollar Index looks to Fed, yields

The index partially fades Monday’s advance amidst a so far tepid recovery in the risk complex on turnaround Tuesday.

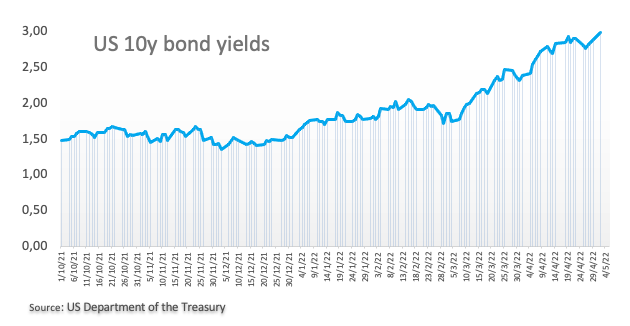

Indeed, the index trades in an erratic fashion against the backdrop of the continuation of the upside momentum in US yields. On this, it is worth recalling that the 10y benchmark note yields trespassed the key 3.0% mark for the first time since December 2018 on Monday.

The greenback is expected to remain in a cautious mode as the FOMC’s meeting kicks in on Tuesday and is expected to deliver a 50 bps interest rate hike on Wednesday, while further announcements regarding the future rate path and the balance sheet runoff should also keep the dollar entertained.

Data wise in the US calendar, Factory Orders for the month of March are due later seconded by JOLTs Job Openings/Quits in the same period.

What to look for around USD

The dollar remains vigilant well above the 103.00 mark ahead of the key FOMC gathering on Wednesday. The Fed’s more aggressive rate path continues to be the main driver behind the robust bullish stance in the dollar, which also appears reinforced by the current elevated inflation narrative and the solid health of the labour market. Collaborating with the latter appear bouts of geopolitical tensions as well as the move higher in US yields.

Key events in the US this week: Factory Orders (Tuesday) – Mortgage Applications, ADP Report, Balance of Trade, Final Services PMI, ISM Non-Manufacturing, FOMC Meeting (Wednesday) – Initial Claims (Thursday) – Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is retreating 0.02% at 103.57 and faces the next support at 99.81 (weekly low April 21) seconded by 99.57 (weekly low April 14) and then 97.68 (weekly low March 30). On the upside, the breakout of 103.92 (2022 high April 28) would open the door to 104.00 (round level) and finally 105.63 (high December 11 2002).