WTI Price Analysis: Looks to retest seven-year highs above the $78 mark

- WTI consolidates near 2014 peaks as OPEC+ maintains oil output hike.

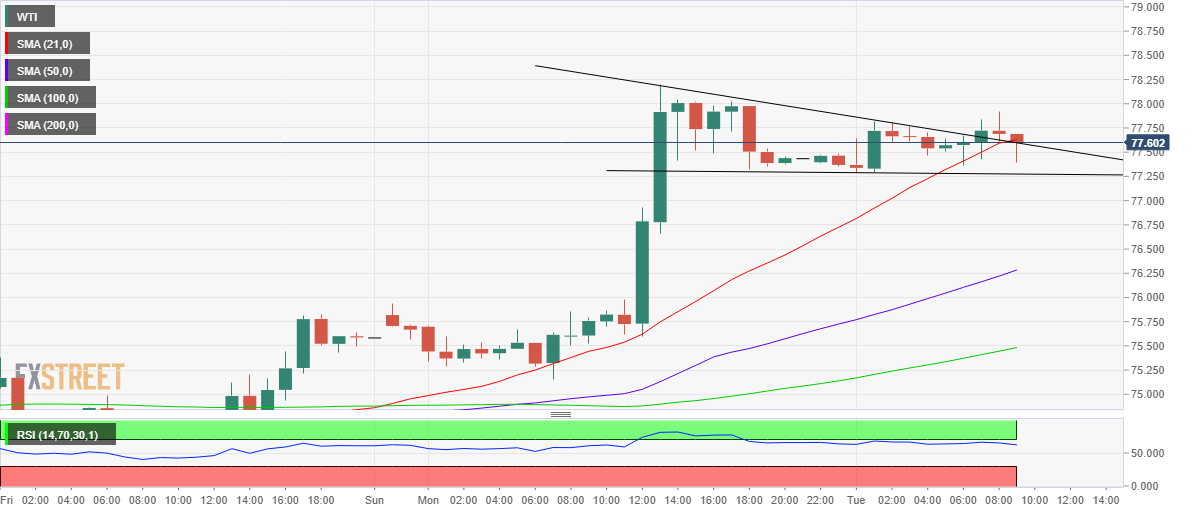

- The US oil spots a descending triangle breakout on the hourly chart.

- Hourly RSI holds comfortable above the midline.

WTI (NYMEX futures) is posting modest gains, consolidating Monday’s rally to the highest levels since 2014 at $78.20 after OPEC and its allies decided to stick with 400,000 barrels per day (bpd) of oil output hike.

So far this Tuesday, WTI bulls are catching a breather amid resurgent US dollar demand across the board, as the risk sentiment remains weighed down by China property market concerns and inflation worries.

The return of appetite for the riskier assets, in the wake of encouraging China Evergrande news, receding US Treasury yields and the aversion of a potential US government shutdown, is boding well for the higher-yielding WTI.

From a short-term technical perspective, WTI’s consolidative mode could pave the way for a fresh leg higher, as the bulls look to retest the multi-year peaks above $78.

The black gold has charted a descending triangle breakout on the hourly chart, on a sustained break above the falling trendline resistance at $77.66

The Relative Strength Index (RSI) continues to hover within the bullish territory - well above the central line, allowing room for more gains.

Ahead of the yearly tops, WTI bulls need to find acceptance above the ascending 21-Hourly Moving Average (HMA) at $77.70.

WTI: Hourly chart

However, if the price breaches the triangle support at 77.25 on an hourly closing basis, then the bullish breakout would be invalidated, with a corrective decline likely on the cards.

WTI price could tumble to test the bullish 50-HMA at $76.28 on selling resurgence.

WTI: Additional levels to watch