US inflation expectations stay firmer heading into FOMC

US inflation expectations remain in the recovery mode, stronger for the short and medium-term, global markets brace for the Federal Open Market Committee (FOMC) meeting results, up for publishing amid late Wednesday.

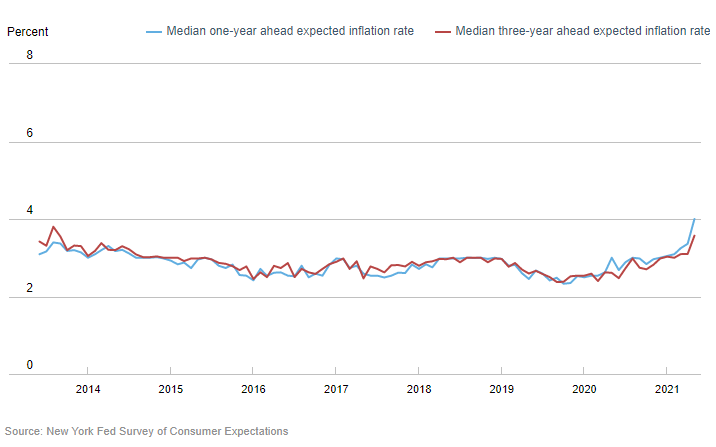

Be it Consumer Expectations survey by the New York Fed or per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, early signals suggest the price pressure mounts over the Fed.

New York Fed Survey of Consumer Expectations for one year jumped to the record high in May, around 4.0%, whereas the poll results of three-year ahead expected inflation rate jumped to the late 2013 levels while flashing 3.6% mark.

On the other hand, FRED data portray an extended recovery of the inflation gauge for 10 years to 2.38% at the latest. In doing so, the 10-year breakeven inflation rate refreshes the weekly high after dropping to the lowest in two months on Friday, when posting a 2.32% level.

These inflation figures join the latest strong US data to argue Fed Chairman Jerome Powell & Company as they term it “transitory”. As a result, market sentiment remains sluggish ahead of the key event.

Read: Federal Reserve Preview: First up, then down? Playbook for trading the Fed