Back

16 Apr 2021

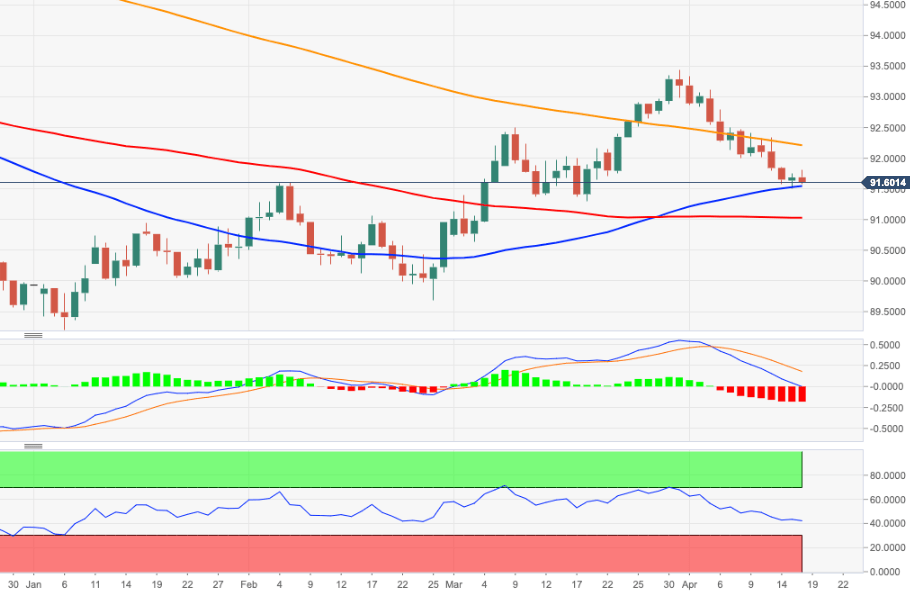

US Dollar Index Price Analysis: Next support emerges at 91.30

- DXY’s leg lower met contention in the 91.50 region so far.

- A deeper pullback targets 91.30 ahead of the 91.00 neighbourhood.

DXY remains immersed into the bearish territory, although it seems to have met quite decent contention in the mid-91.00s for the time being. This area of support is reinforced by the 50-day SMA, today at 91.59.

That said, a break below this area of recent lows carries the potential to spark another leg lower to, initially, the 91.30 zone, where sit weekly lows recorded in mid-March.

Further south is located the 100-day SMA just above the 91.00 yardstick.

Below the 200-day SMA (92.21) the outlook for DXY is expected to remain on the negative side.

DXY daily chart