AUD/USD Price Analysis: Recovery moves eye 0.7810 resistance confluence

- AUD/USD picks up bids to refresh intraday high.

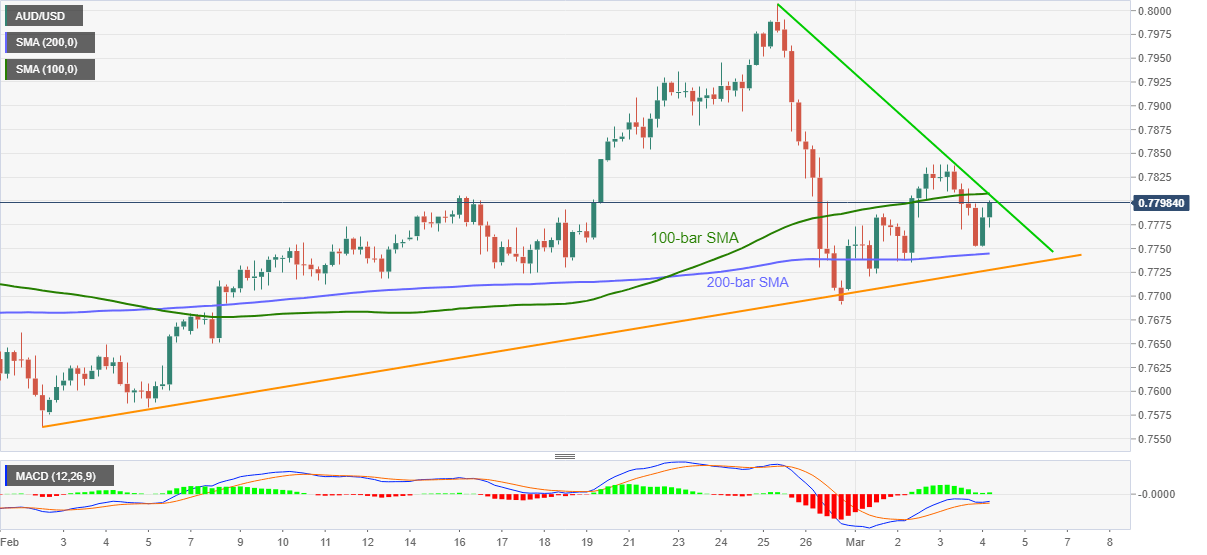

- Repeated bounces around 200-bar SMA, bullish MACD favor buyers.

- 100-bar SMA, one-week-old falling trend line challenge bulls.

AUD/USD takes the bids near 0.7800, intraday high of 0.7801, while heading into Thursday’s European session. In doing so, the quote justifies its U-turn ahead of 200-bar SMA, portrayed earlier in Asia, amid the bullish MACD.

That said, the AUD/USD buyers currently eye 0.7810 hurdle comprising 100-bar SMA and a falling trend line from February 25.

Also acting as an upside barrier is the weekly top surrounding 0.7840, a break of which will quickly propel the run-up to February’s peak near 0.8010. During the rise, the 0.7900 threshold can offer a breather to the AUD/USD bulls.

Meanwhile, a downside break of 200-bar SMA level of 0.7744 needs validation from the one-month-old support line and the previous week’s low, respectively around 0.7727 and 0.7691, to recall the AUD/USD sellers.

Following that, the quote could drop to early February tops around mid-0.7600s.

Overall, AUD/USD remains in an uptrend as shown by an ascending trend line from February 02.

AUD/USD four-hour chart

Trend: Further upside expected