USD/CAD Price Analysis: Wavers around three-year low with eyes on 1.2500

- USD/CAD consolidates recent losses near multi-month low.

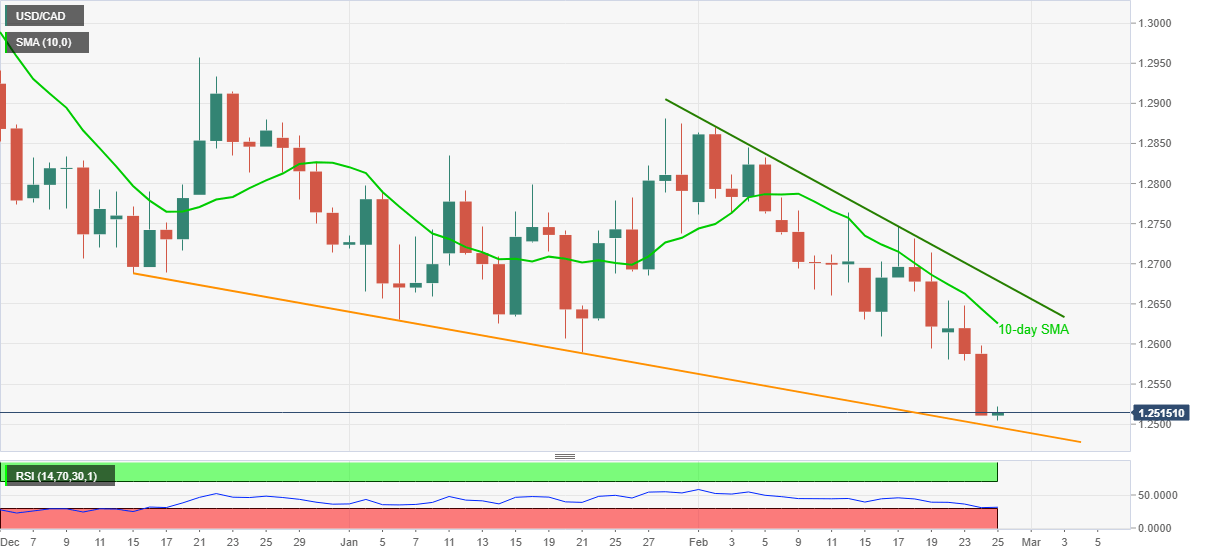

- 10-week-old support line can challenge the bears amid oversold RSI.

- Bulls need to cross monthly resistance line for conviction.

Following its early Asian drop to the fresh low since February 2018, USD/CAD seesaws in a choppy range above 1.2500, currently up 0.05% around 1.2515, during Thursday.

In doing so, the loonie pair takes clues from oversold RSI conditions while also stays above the downward sloping trend line from December 15, 2020.

Considering the strong support and RSI conditions, USD/CAD is likely to extend the latest corrective pullback towards immediate hurdle, namely the 10-day SMA level of 1.2625. However, the 1.2600 can test the recovery moves.

It should, however, be noted that the pair’s upside past-10-day SMA depends upon its capacity to cross a three-week-old descending trend line, currently around 1.2680.

Alternatively, a downside break of 1.2500 will defy recovery hopes and can direct the USD/CAD prices towards the year 2016 low near 1.2460.

Overall, USD/CAD remains bearish but short-term bounce can’t be ruled out.

USD/CAD daily chart

Trend: Corrective pullback expected