EUR/USD Price Analysis: EUR bulls look sceptical despite falling wedge breakout

- EUR/USD’s upside looks elusive despite the technical breakout.

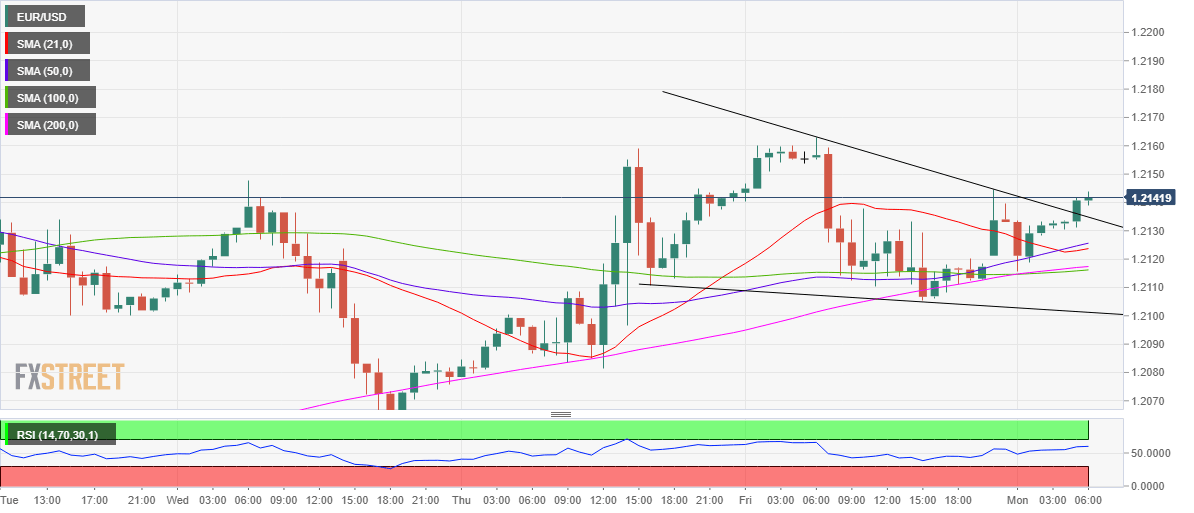

- A falling wedge bullish break confirmed on the hourly chart.

- Bearish crossovers, bullish RSI put EUR bulls in limbo.

EUR/USD struggles to extend its recent uptick while holding moderate gains above the 1.2100 level.

The main currency pair caught a fresh bid wave in the last hour and broke through its recent consolidative phase within a falling wedge formation, confirming an upside break on the hourly chart.

The Relative Strength Index (RSI) points north above the 50.00 level, indicating that there is more room to the upside.

However, the bearish crossovers emerge as the cause for concern. The 21-hourly moving average (HMA) cut the 50-HMA from above while the 100-HMA slipped under the 200-HMA.

The divergence on the chart could make it an uphill task for the bulls should the buying pressure intensify.

The pattern target is measured at 1.2189. Ahead of that the spot needs to clear the 2020 highs of 1.2177. To the downside, strong support is aligned at 1.2125, the convergence of 21 and 50-HMAs.

Further south, the 200-HMA cushion at 1.2117 could be the last resort for the buyers.

EUR/USD: Hourly chart

EUR/USD: Additional levels