Back

20 Oct 2020

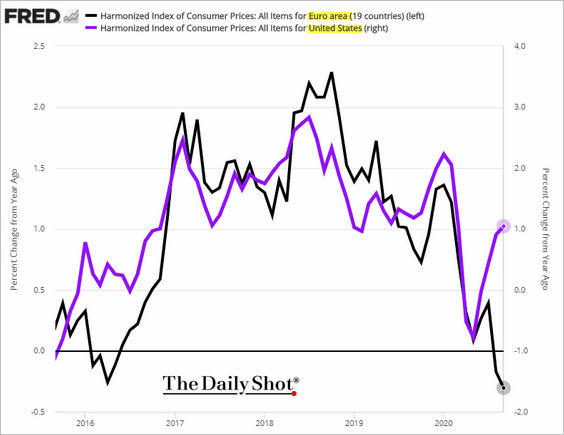

EUR bearish: the Eurozone-US CPI gap has been unusually wide

The US-EU inflation differential is widening and could have bearish implications for EUR/USD.

The US harmonized index of a consumer price index (CPI) has risen to 1%, while its Eurozone counterpart has dropped into the negative territory. As such, the Eurozone-US CPI gap looks unusually wide, as noted by Wall Street Journal's "The Daily Shot newsletter."

The widening inflation differential strengthens the case for additional easing by the European Central Bank and could keep the EUR on the offer in the near term.