Gold Price Analysis: Battle lines well-mapped as XAU bulls await fresh impetus – Confluence Detector

Gold consolidates the rally to fresh seven-year highs at $1773.57, as the bulls await fresh catalysts for the next push higher. A test of $1800 due on the cards?

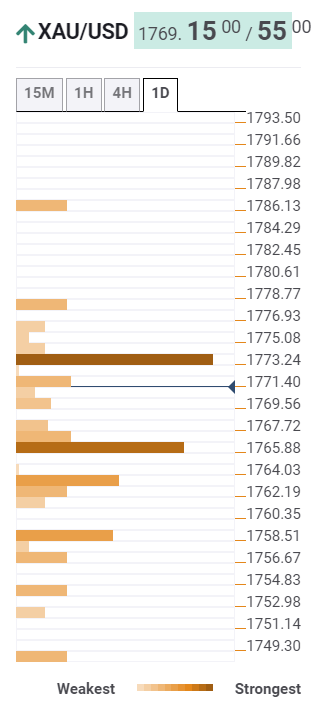

As observed in the Technical Confluences Indicator, the precious metal-faced rejection near $1774 on its dollar slump-inspired rally. That hurdle is the confluence of the Pivot Point one-week Resistance 2 and Pivot Point one-month Resistance 1.

A daily closing above the latter is likely to fuel a fresh run for a test of the key $1800 mark, in absence of healthy resistance levels.

Alternatively, any corrective move lower will meet some strong demand at $1766, where the previous month high and Fibonacci 23.6% one-day intersect.

Selling pressure is likely to intensify below a break of the aforesaid support, with the next minor support at $1763.50 to come into play (Bollinger Band one-day Upper).

Here is how it looks on the tool

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.