EUR/USD meets support near 1.0840 post-data, looks to Fed

- EUR/USD trims earlier gains but met contention near 1.0840.

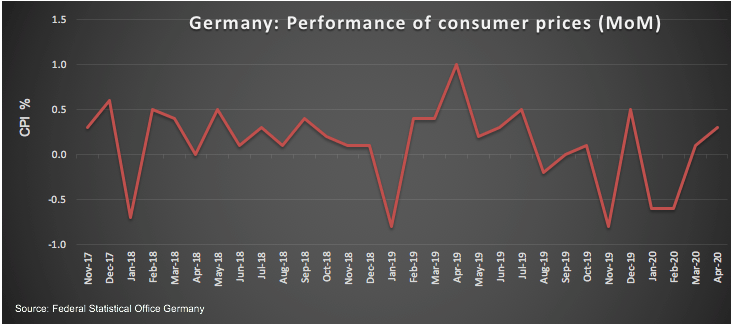

- German advanced April CPI surprised to the upside at 0.3% MoM.

- US flash Q1 GDP seen contracting at an annualized 4.8%.

After climbing to the 1.0870/75 band earlier, sellers stepped in and dragged EUR/USD to the 1.0840 area, where it seems to have met some decent contention.

EUR/USD now looks to FOMC

EUR/USD keeps the buying bias unaltered, although a test/surpass of the key barrier at 1.0900 the figure still looks elusive for the time being.

The pair is therefore regained the upside bias on the back of the resumption of the selling pressure around the greenback, all against the backdrop of a better context in the risk-associated universe.

In the docket, German flash inflation figures tracked by the CPI showed consumer prices are seen rising at a monthly 0.3% and 0.8% on a year to April. The broader HICP is expected at 0.4% inter-month and 0.8% over the last twelve months.

Across the pond, first estimates of the US GDP show the economy is expected to contract 4.8% on a yearly basis. Moving forward, Pending Home Sales are next on tap ahead of the key FOMC meeting.

What to look for around EUR

The euro extends the recovery from recent lows and is now shifting its focus to the 1.0900 region. As always, developments from the coronavirus and its impact on the economy are expected to keep ruling the sentiment in the global markets for the time being, while optimism on a gradual re-start of the economic activity in some members of the bloc has given extra oxygen to the single currency as of late. On the more macro view, the euro is expected to remain under scrutiny in light of the predicted contraction of the bloc’s economy in the first half of the year, relegating hopes of a potential recovery to Q3 and/or Q4.

EUR/USD levels to watch

At the moment, the pair is gaining 0.41% at 1.0863 and a break above 1.0888 (weekly high Apr.28) would target 1.0943 (55-day SMA) en route to 1.0990 (weekly/monthly high Apr.15). On the flip side, immediate contention is located at 1.0814 (78.6% Fibo of the 2017-2018 rally) seconded by 1.0727 (weekly low Apr.24) and finally 1.0635 (2020 low Mar.23).