AUD/JPY technical analysis: Stays inside falling channel after RBA decision

- AUD/JPY stays inside a three-day old descending channel, below 100-HMA.

- RBA refrained from any policy change while holding cautiously bearish bias.

- A downside break of channel support highlights 70.00 mark.

Despite post-RBA bounce, AUD/JPY remains below short-term key resistances as it takes the bids to 71.32 while heading into Tuesday’s European open.

The Reserve Bank of Australia (RBA) held its monetary policy unchanged in today’s meeting while leaving the doors open for further rate cuts if needed to support sustainable growth.

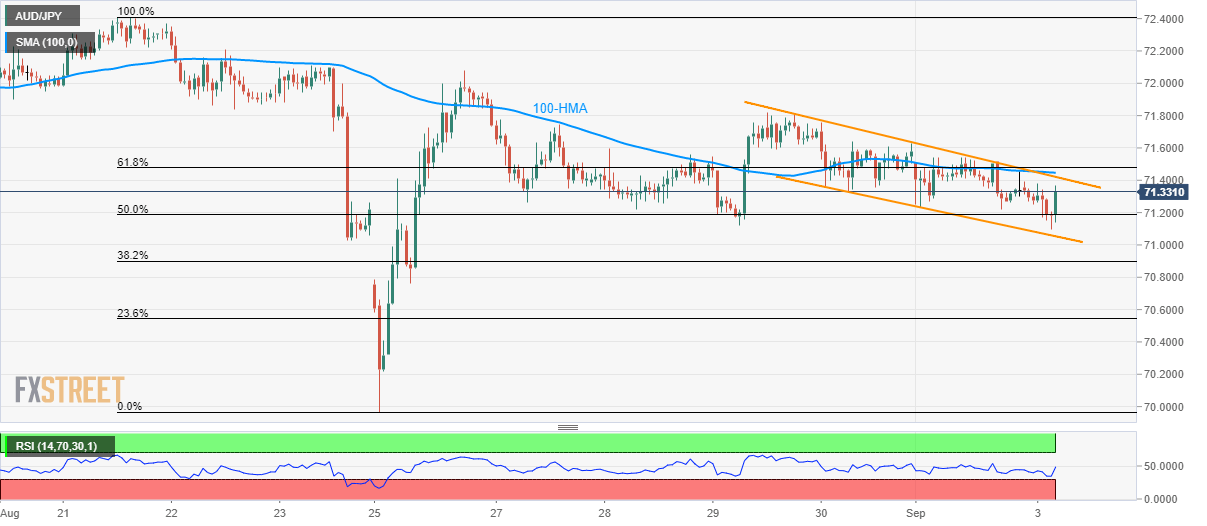

While 50% Fibonacci retracement of August 21/25 downpour, at 71.20, acts as immediate support, sellers may wait for the break of the channel’s support, near 71.00, to target 70.76 and August 25 low close to 70.00.

Meanwhile, pair’s upside clearance of 71.42/48 area including channel’s upper-line, 100-hour simple moving average (HMA) and 61.8% Fibonacci retracement can trigger fresh run-up to August 29 top near 71.82.

During the pair’s additional rise after 71.82, 72.00 and August 21 high around 72.40 can lure the bulls.

AUD/JPY hourly chart

Trend: bearish