GBP/USD sidelined below 1.2300, Brexit weighs

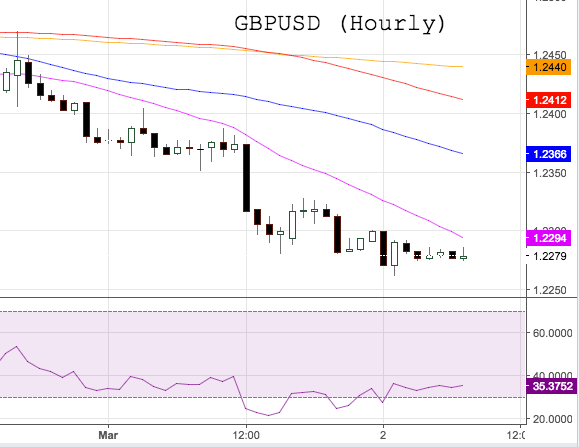

The Sterling is prolonging its weekly bearish note on Thursday, dragging GBP/USD to test fresh lows in sub-1.2300 levels.

GBP/USD weaker on Brexit, data

Spot is retreating for the fifth consecutive session so far, losing extra ground following disappointing results from the key PMI Manufacturing, UDD-buying and renewed fears on a ‘hard Brexit’ scenario.

In fact, the continuation of the rally in the greenback remains bolstered by rising expectations of a Fed move at the meeting later in the month, weighing in the risk-associated universe and forcing the pair to extend the rejection from recent tops in the 1.2570/75 band.

Additionally, the Brexit bill faces further delay after the House of Lords voted 358 to 256 on Wednesday to amend the bill, demanding guarantees for more than 3 million EU citizens living in the UK after the country leaves the European bloc. The bill should now return to the House of Commons for deliberation. Despite this setback for the Government, PM Theresa May insisted she expects to trigger Article 50 by end of March.

Data wise in the UK, Construction PMI is due later ahead of the more relevant Services PMI expected on Friday. Across the pond, the usual weekly report on the US labour market will be the sole publication in the US economy.

GBP/USD levels to consider

As of writing the pair is losing 0.11% at 1.2281 and a break below 1.2262 (low Mar.2) would aim for 1.2250 (low Jan.19) and finally 1.2036 (low Jan.11). On the flip side, the initial up barrier aligns at 1.2301 (high Mar.2) followed by 1.2395 (55-day sma) and then 1.2410 (100-day sma).