Back

20 Sep 2023

Natural Gas Futures: A near-term correction emerges on the horizon

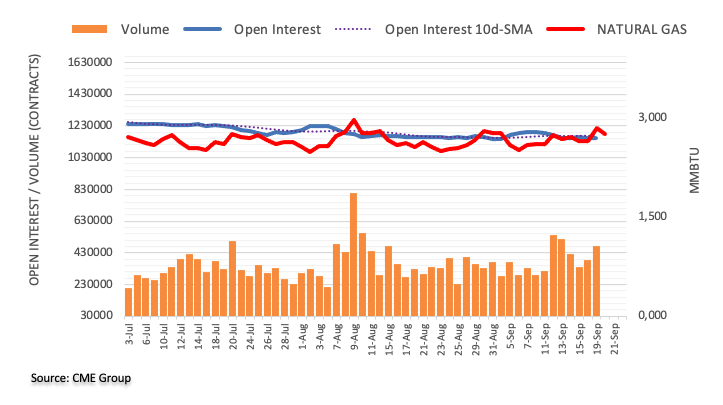

Considering advanced prints from CME Group for natural gas futures markets, open interest shrank for the second session in a row on Tuesday, this time by around 2.5K contracts. On the other hand, volume added around 89.2K contracts to the previous daily build.

Natural Gas remains capped by $3.00

Natural gas prices extended the weekly recovery on Tuesday, flirting at the same time with the key 200-day SMA near the $2.90 region. The uptick was on the back of shrinking open interest and is indicative that a potential knee-jerk could be in the offing in the very near term. In the meantime, the $3.00 region per MMBtu remains a key resistance area for the time being.